Asset Protection, Tax Reduction, And Wealth Preservation Strategies Under One Roof.

Discover how you can protect your assets, reduce taxes, and shield your loved ones from several layers of hidden taxes and legal costs by aligning the manner in which you make legal, tax, and financial decisions with our help.

Here is the basic version of the tax code: Every dollar you earn, inherit, invest, and pass-on is subject to multiple layers of taxation - some are taxed during your life and some are taxed at your death.

This concept is depicted in a concept that we refer to as The Tax Iceberg™ (picture attached).

Most individuals and their experts are caught in deferring or lowering the taxes found "above the surface" (income and capital gains taxes), leaving hidden taxes that lurk beneath the surface for loved ones to tackle on their own - right after their death!

It's your beneficiaries and loved ones who have to tackle complex probate court proceedings, legal costs, delays, and a plethora of taxes and costs before they can receive your wealth.

We specialize in helping you formulate and incorporate the strategies that can help you tackle these layers of legal costs and taxes with more confidence.

We Strategically Assess Your Goals Through Three Potential Lenses

This approach allows us to look at the same scenario from several strategic perspectives and identify hidden gaps that could leave your wealth exposed to creditors or even unnecessary taxes

Asset Protection Lens

Asset protection looks at the different strategies that can be used to lower your chances of getting sued, and if you do get sued, how to position your assets and entities to minimize the risks and potential losses from the lawsuits.

Tax Reduction Lens

Tax reductions lens looks at several different layers of taxes that impact every dollar that you own and control (cash or assets) and how to position different entities to minimize the taxes faced during your life and after your death.

Estate Planning Lens

We look at your overall goals and dreams and how to empower your heirs and loved ones so they know how to manage your wealth after your death in a manner that is not risky and will not be diluted or depleted due to poor financial management.

Aligning Law, Tax, And Financial Strategies Under One Roof

Watch this short video to understand how different experts you are working with are contributing to your estate and tax obligations down the line and how you can ensure your loved ones do not have to deal with these layers of hidden taxes and costs due to poor estate and tax planning on your part

Our Leadership Team

We are a diverse team of entrepreneurs, investors, attorneys, accountants, insurance agents, financial advisors, and business consultants who are on a mission to empower families with the estate & tax planning strategies they need to thrive on all fronts

Balaji Parthasarthy:

Mr. Parthasarthy is a highly seasoned and passionate Business Consultant, Insurance Agent, and Financial Advisor who has worked with families from all walks of life and financial goals.

He has over two decades of experience in technology and financial planning and has transitioned into the world of financial and insurance advisory to accomplish more work-life balance and pursue his personal interest in the financial markets.

Balaji joined forced with Attorney Sid Peddinti to form a Mini Family Office™ that works with families who are in the accumulation of wealth stage and want to enhance their legal protection while lowering taxes on several fronts.

Sid Peddinti, Esq.

Sid Peddinti is a TEDx Speaker, Estate & Tax Attorney, and Legal Innovator, who has worked in the estate and tax restructuring space for over two decades and has worked with business owners and investors from diverse backgrounds in multiple niches.

He specializes in helping people "piece" together the law, tax, and financial pieces of the puzzle using robust estate and tax planning vehicles that are used by the ultra-wealthy - which he believes all of us should be leveraging as well.

Sid is one of the foremost experts in asset and tax restructuring and spends a big chunk of time educating and training professionals in diverse industries with estate and tax planning knowledge that can help them add more value to their offerings.

We look forward to serving you and your family!

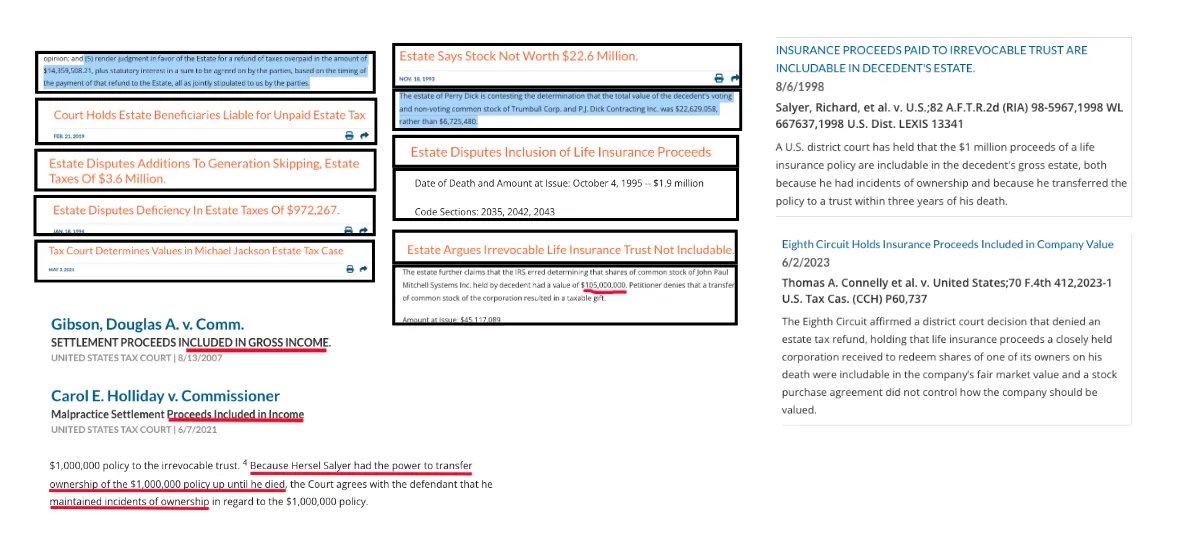

What Happens When You Don't Plan And Get Organized?

Your Loved Ones End Up With Situations Like This...

We want to help you and your loved ones avoid these sorts of scenarios. Schedule a call to see how we can help you get planned and organized using the right estate and tax planning vehicles.

What we offer

Legal consulting

We offer a broad range of estate planning services including:

Simple estate plans

Complex estate plans

Trusts and foundations

Incorporations and LLCs

Nonprofit organizations

Insurance trusts (ILITs)

Tax consulting

We offer a range of tax reduction strategies including:

Income tax

Capital gains tax

State probate and legal costs

State inheritance tax

Federal estate and gift tax

Alternative tax structures

Financial consulting

We assist with a range of financial and insurance related services:

Conversion of investments

Portfolio diversification

Stock and other investments

Life insurance: term policies

Life insurance: IUL, PF, and WL

Leveraging insurance for growth

Different Strategies Boxes For Different Wealth Buckets

Box 1:

Under $1 Million In Assets

If the total fair market value of all your assets is under $1 million, we can help you get the basic documents that you need to protect your assets and circumvent probate costs and legal costs and while keeping affairs private.

Box 2:

$1 Million - $6 Million

If your net worth is between $1 - $6 million, there's a good chance you'll need a robust estate planning tools to minimize taxes, especially if you are closer to $6m per person (or double for married couples).

Box 3:

$6 Million+

If your net worth is above $6 million (or double for married couples), any excess over that amount might be subject to 40% estate taxes! You are going to need a comprehensive set of strategies and ongoing consulting to circumvent those.

The Next Step Is To Schedule A Detailed Estate And Tax Evaluation Where We Can Calculate The "Hidden Taxes" That Your Estate Could Face Down The Line...And Create A Roadmap To Tackle These Layers Of Taxes And Legal Costs

© 2024 WM Wealth Magicians is a consulting firm that is created using the Mini Family Office™. All trademarks, copyrights, and intellectual assets are owned by Mini Family Office™. All Rights Reserved. Copyrighted Material. No legal, tax, financial, or investment advice provided or contained.